Here are some very simple working examples of very standard DSGE Models. In the following codes, I employ two methods to solve rational expectations models. The resolution is performed via the dynare package (requires Matlab or octave) initially developed by Michel Juillard. The second way is through matlab codes written by Paul Klein, Bennett McCallum and Edward Nelson. All theses codes are based on the generalized Schur form to solve a systems of linear expectational difference equations.

Real Business Cycle Models (RBC)

In this section, I share very standard business cycle models very close to the canonical neo-classical growth model. I extend the set-up with several real rigidities taken from Christiano

et al. (2005) and Smets and Wouters (2003, 2007) which aim at enhancing the empirical relevance of macro-models.

The basic RBC Model with Physical Capital

RBC Model with external habits

Dynare Codes Matlab Codes

In this setting, we consider that each household has external consumption habits. This feature captures the autocorrelation of consumption observed in the data. Thus the utility function subject to external habits reads as follows:

RBC Model with investment adjustment costs

Dynare Codes Matlab Codes

To introduce asset price fluctuations, households supplying investment goods face an investment adjustement costs given by:

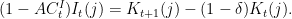

The law of motion of capital with investment adjustment costs is defined by:

These costs drive a wedge between the price of assets and goods and offer a tradeoff beetwen capital goods and riskless bonds.

RBC Model with variable capital utilization

New Keynesian Model codes (NK)

In this section, the previous basic RBC model is extended to account for nominal rigidities implied by price stickiness.

New Keynesian Model with price indexation

Here are my own codes for models published in peer-review journals.

Global banking and the conduct of macroprudential policy in a monetary union

pdf Journal

Dynare Code

This paper questions the role of cross-border lending in the definition of national macroprudential policies in the European Monetary Union. We build and estimate a two-country DSGE model with corporate and interbank cross-border loans, Core-Periphery diverging financial cycles and a national implementation of coordinated macroprudential measures based on Countercyclical Capital Buffers. I provide here the estimated model (at the mode), not the optimization exercise.

A Welfare Analysis of Macroprudential Policy Rules in the Euro Area

pdf Journal

Dynare Code

In this paper published in Revue d’Economie Politique in 2017, we estimate DSGE model of the European Monetary Union that accounts for financial differences between core and peripheral countries. We find that country-adjusted macroprudential measures lead to significant welfare gains with respect to a uniform macroprudential policy rule that reacts to union-wide financial developments. However, peripheral countries are the winners from the implementation of macroprudential measures while core countries incur welfare losses, thus questioning the interest of adopting coordinated macroprudential measures with peripheral countries.

Financial Frictions and the Extensive Margin of Activity

pdf Journal (RiE)

Dynare Code

Data

In this paper published in Research in Economics in 2015, we evaluate the role of financial frictions on the decision to create new goods/startups using an estimated DSGE model. We extend the initial framework of Bilbiie, Ghironi and Melitz (2012) and augment it with real, nominal and financial frictions to get a data friendly model. The model is estimated using Bayesian techniques for the US economy. I share the model which is calibrated on the posterior estimated mean value of deep parameters and shocks, I also share the data involved in the estimation exercise.

Cross-border lending (interbank and corporate) in an Estimated DSGE model

pdf Journal (JEDC)

Dynare Codes

This model is the first estimated DSGE model with cross-border lending and has been published in the

Journal of Economic Dynamics and Control (2015). I cannot give the data, these are internal to ECB and cannot be shared. The given mod file is calibrated on the estimated parameters and shocks in our paper (at the posterior mean).

A Simple dynamic 3-equation New Keynesian Model

pdf

Dynare Codes

This code was published in the Economics and Business Review hosted by the University of Poznan. This paper aims at introducing New Keynesian Macroeconomics for graduate students. This paper is currently taught in the Master Program of the University Paris-Dauphine, University of Rennes and the University of Poznan.

Bibliography

Melitz, M., Bilbiie, F. O., & Ghironi, F. (2012). Endogenous Entry, Product Variety, and Business Cycles. Journal of Political Economy, 120(2).

Calvo, G. A. (1983). Staggered prices in a utility-maximizing framework. Journal of monetary Economics, 12(3), 383-398.

Christiano, L. J., Eichenbaum, M., & Evans, C. L. (2005). Nominal rigidities and the dynamic effects of a shock to monetary policy. Journal of political Economy, 113(1), 1-45.

Poutineau, J. C., & Vermandel, G. (2015). Cross-border banking flows spillovers in the Eurozone: Evidence from an estimated DSGE model. Journal of Economic Dynamics and Control, 51, 378-403.

Poutineau, J. C., & Vermandel, G. (2015). Financial frictions and the extensive margin of activity. Research in Economics, 69(4), 525-554.

Poutineau, J. C., & Vermandel, G. (2017). A Welfare Analysis of Macroprudential Policy Rules in the Euro Area. Revue d Economie Politique.

Poutineau, J. C., & Vermandel, G. (2017). Global banking and the conduct of macroprudential policy in a monetary union. Journal of Macroeconomics, 54, 306-331.

Rotemberg, J. J. (1982). A monetary equilibrium model with transactions costs.

Smets, F., & Wouters, R. (2003). An estimated dynamic stochastic general equilibrium model of the euro area. Journal of the European economic association, 1(5), 1123-1175.

Smets, F., & Wouters, R. (2007). Shocks and frictions in US business cycles: A Bayesian DSGE approach. National bank of belgium working paper, (109).