Summary

The lectures provide an applied presentation of standard forecasting models which are typically employed in policymaking institutions to forecast macroeconomic time series. Lectures are followed by practical sessions with hands-on computational exercises on MATLAB software.

Get the Syllabus

Installing MATLAB: Dauphine

provides a free licence for students. Please use your own laptop if you can with MATLAB installed. Please have Datafeed, Optimization and Econometrics toolboxes installed. You will need to tick them in the package list during the installation of MATLAB.

Real time macro-data on MATLAB

This is a must-read as all of the lectures will rely on DBnomics. The latter is a database aggregator which can be queried directly from MATLAB. Please read carefully this following note on DBnomics and download as well the MATLAB function which allows to get real time macro data:

DBnomics.pdf a small guide to use DBnomics on MATLAB.

call_dbnomics.m MATLAB function to query DBnomics.

Introduction to MATLAB programming

This introduction should take no more of four hours of in class teaching.

Lecture 1: Introduction to MATLAB Programming

Objectives of the Lecture:

- Utilize the basic mathematical operations;

- Get know the general purpose commands of Matlab;

- Manipulate matrix calculus;

Materials:

Lecture 2: Plotting

Objectives of the Lecture:

- UPlotting 2D and 3D graphs;

- Define the curve shape, titles and legends.

Materials:

Lecture 3: Loops and Conditional Statements

Objectives of the Lecture:

- Mastering the use of conditional statements;

- Coding loops with both while and for.

Materials:

Lecture 4: Functions

Objectives of the Lecture:

- Write a function with n-input arguments;

- Code a function n-output variables;

Materials:

Handouts list

Handout 1: Building a (stationary) dataset

Objectives of the Lecture:

- Understanding the concept of stationarity in time series.

- Mastering how to stationarize time series.

- Detection unit root components.

Materials:

Handout 2: The AR(p) Benchmark model

Objectives of the Lecture:

- Constructing a likelihood function;

- Estimating an AR(p) model;

- Performing forecasting analysis: both in-sample and out-sample;

- Finding the optimal lag using likelihood comparison test;

- Understanding the basis of the state-space representation.

Materials:

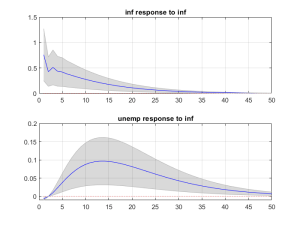

Handout 3: Vecto Auto-Regressive (VAR) models

Objectives of the Lecture:

- Building and estimate a VAR Model;

- Performing business cycles analysis;

- Imposing restrictions on the VAR coefficients;

- Performing forecasting.

Materials:

Handout 4 DSGE models (Real Business Cycles)

Objectives of the Lecture:

- Introducing to the simulation of a very simple business cycle model;

- Solving any theoretical model, find its steady state, log-linearise it and plot its IRFs;

- Computing second moment statistics by hand using artificial series.

Materials:

Handout 5: DSGE models (a full-fledged Real Business Cycles model)

Objectives of the Lecture:

- Building and estimate a VAR Model;

- Performing business cycles analysis;

- Imposing restrictions on the VAR coefficients;

- Performing forecasting.

Materials:

Handout 5: macroeconometrics of DSGE models

Objectives of the Lecture:

- Introducing to the simulation of a very simple business cycle model;

- Solving any theoretical model, find its steady state, log-linearise it and plot its IRFs;

- Computing second moment statistics by hand using artificial series.

Materials:

Toy models list

Here is the list of available models that are necessary for your examination. You will need to use one these toy models, and compare its forecasting hability with a benchmark VAR and AR models.

Entrepreneurs credit frictions